Finpro GAAP Knowledge Quest

Impact on accounting for financial instruments due to Interest Rate Benchmark Reform (IRBR)

Overview

By the end of year 2021, some major interbank offer rates such as LIBOR, EURIBOR, TIBOR will cease to be published and will be replaced by new interest rate benchmarks. This poses challenges for accounting of broad range of financial products and contracts which use these interbank offer rates as benchmarks.

To address these challenges amendments have been made by IASB to the relevant IFRS’ and in India, corresponding changes have been made to Ind AS’.

The amendments are issued to provide guidance on accounting of financial instruments during the phase of transitioning to new benchmarks (pre replacement phase) and after the replacement of existing interbank offer rates with new rates (replacement phase).

This document aims to summaries the amendments and explain their practical applicability by way of an example.

What is Interest Rate Benchmark Reform?

Interest rate benchmarks (IRBs) / Inter Bank Offer rates (IBORs) are interest rates that are updated on a regular basis and publicly accessible. They are a useful basis for all kinds of financial products and contracts such as loans, bonds, derivatives, etc. Benchmark rates are calculated by an independent body and they reflect the cost of borrowing money in different markets.

Before 2014, due to some cases of attempted market manipulation and false reporting of global reference rates and post-crisis decline in liquidity in interbank unsecured funding markets, there was uncertainty surrounding the integrity of existing interbank benchmark interest rates which represented a potentially serious source of vulnerability and systemic risk.

Hence, the G20 (The G20 is an intergovernmental forum comprising 19 countries and the European Union (EU) which works to address major issues related to the global economy) asked the Financial Stability Board (FSB) to undertake a fundamental review of major interest rate benchmarks (IRBs) to ensure that IRBs are robust and appropriately used by market participants.

The FSB is an international body that monitors and makes recommendations about the global financial system. In July 2014, FSB issued a report titled ‘Reforming Major Interest Rate Benchmarks’.

Consequently, some major IBORs viz. LIBOR, EURIBOR, TIBOR, etc. are undergoing a reform and by the end of year 2021, these rates will cease to be published and will be replaced by new interest rate benchmarks.

This reform is to ensure that IRBs are more robust and appropriately used by market participants.

Impact on accounting for financial instruments due to Interest Rate Benchmark Reform (IRBR)

How does IRBR affect accounting?

Change in the IRBs poses challenges for accounting of broad range of financial products and contracts which use these benchmarks. E.g., A variable interest rate loan which is charging interest to borrower based on LIBOR + margin will undergo a change as LIBOR will be replaced by some other IRB.

The accounting challenges have been addressed by International Accounting Standards Board (IASB) by introducing amendments to relevant IFRS’. In India, corresponding changes have been introduced in Ind AS’.

The amendments are issued to provide practical expedients to the entities while accounting for financial instruments during the phase of transitioning to new benchmarks (pre replacement phase) and after the replacement of existing interbank offer rates with new rates (replacement phase).

With the help of an illustration below, we have tried to explain the practical applicability for one common accounting aspect amongst many other.

Illustration

Below is an example to demonstrate accounting of a financial instrument linked to Interbank offer rate – before and after amendment to IFRS / Ind AS.

- Entity A borrows from Entity B an amount of CU 100,000 for a period of 4 years.

- A incurs a transaction cost for this borrowing of CU 500.

- The loan will be repaid in full in a single instalment at the end of tenure.

- Interest will be payable at the end of every year at LIBOR + 2%.

- LIBOR at inception is 3%

- Entity A accounts for this loan at amortized cost.

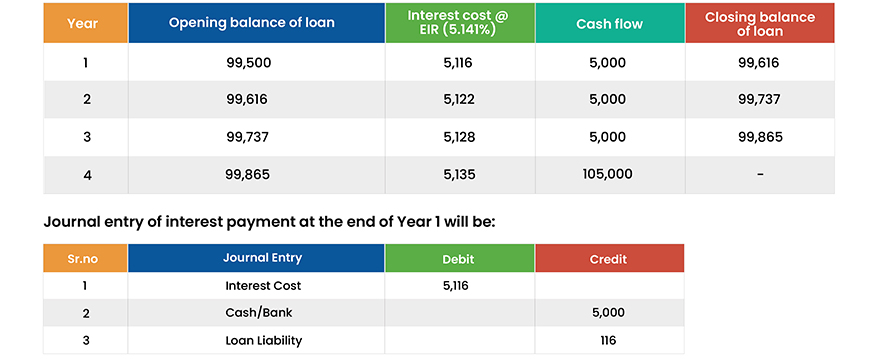

Calculations on Day 1 of Year 1:

Applicable interest rate is LIBOR + 2% which is equal to 5%.

The transaction cost will be adjusted against the loan amount for calculating the cashflows.

The EIR works out to be 5.141%

The amortization schedule will be as below:

Scenario 1: Accounting in the absence of practical expedient under IFRS 9 / Ind AS 109:

At the beginning of Year 2, due to IRBR, the basis for calculation of interest rate changes from LIBOR

+ 2% to NEW IBOR + 3%. Here, ‘NEW IBOR’ is the new interest rate benchmark which will replace ‘LIBOR’. Para 5.4.8 of IFRS 9 / Ind AS 109 allows entities to change the credit spread due to change in IRBR. Thus, in the example, credit spread is changed to 3% from 2% to reflect the change in IRBR and base rate i.e., New IBOR kept same at the level of LIBOR i.e., 3%. This change amounts to renegotiation of the contractual cashflows.

As per para 5.4.3 of IFRS 9 / Ind AS 109 and Para BC 4.253 of IFRS 9, when the contractual cash flows of a financial instrument are renegotiated or otherwise modified without resulting in the derecognition of that financial instrument, an entity shall recalculate the gross carrying amount of the financial asset or amortized cost of a financial liability and shall recognize a modification gain or loss in profit or loss.

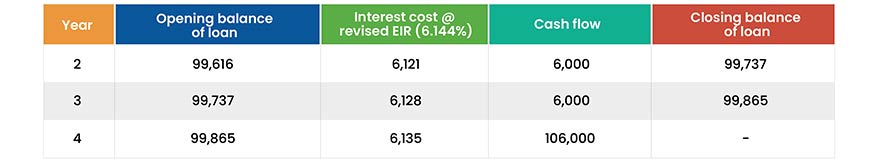

Calculations on Day 1 of Year 2:

Applicable interest rate is NEW IBOR + 3% i.e., 6% (3% + 3%).

In the absence of practical expedient under IFRS / Ind AS, the recalculation of the gross carrying

amount of the financial liability would have been as below:

Journal entry at the beginning of Year 2 will be:

Statement of P&L Debit 2,717

Loan Liability Credit 2,717

The amortization schedule from Year 2 onwards will be as below:

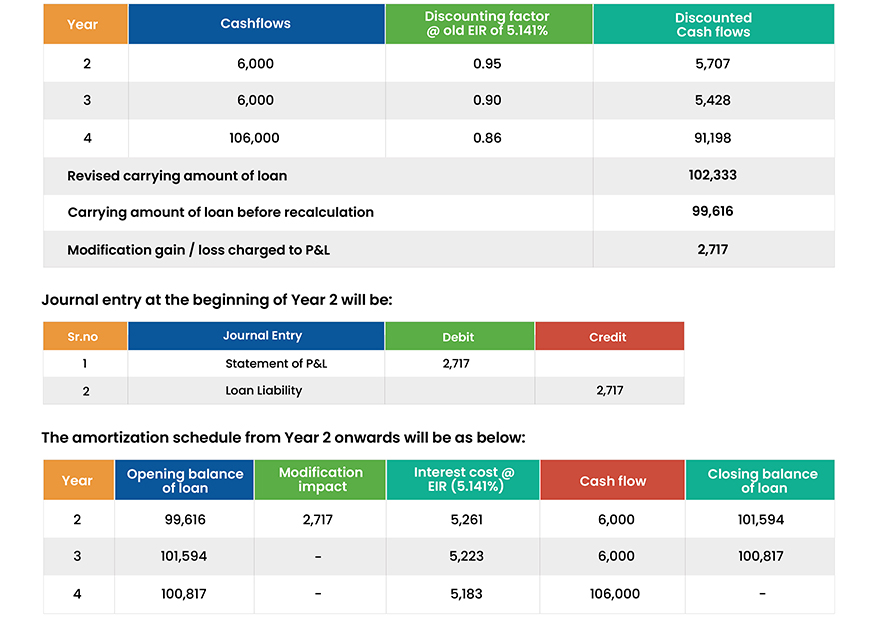

Scenario 2: Accounting based on the practical expedient to IFRS 9 / Ind AS 109:

Let us consider the same facts as mentioned in Scenario 1.

The amendment vide Para 5.4.7, provides for a practical expedient wherein entity shall update the effective interest rate of the financial asset or financial liability to account for a change in the basis for determining the contractual cash flows of a financial asset or financial liability that is required by IRBR.

Due to the practical expedient provided by the amendment, instead of calculating the revised gross carrying amount of the loan, entity will re-calculate its EIR resulting no gain / loss on premeasurement of financial instrument. The re-calculated EIR with changed cash flows amounts to 6.144%

The amortization schedule from Year 2 onwards will be as below:

Conclusion

Respective reporting standards under IFRS and Ind AS have provided practical expedient while accounting for change in contractual cashflows of a financial instrument consequent to change in IRBR. Practical expedients requires an entity ‘to recalculate the new effective interest rate (EIR) based on the new contractual cash flows rather than remeasuring the amortized cost of the financial instrument with impact on the statement of profit or loss in the year of change’. These practical expedients will be applicable only if modification in terms of contract is a direct consequence of IRBR and the new basis for determining the contractual cash flows is economically equivalent to the previous basis.

Comments

Post a Comment