ACCA Dip-IFRS Exam Structure & Time Management Tips

To

overcome the above hurdles or challenges, first important step is to understand

the exam structure or structure of the question paper. Second step is to

understand how the examination utility looks on a computer machine and how to

navigate through the various exhibits in question scenario and how to answer

without losing time in navigation. The third most important and last step is to

practice on such platform in order to reduce time required to solve the

question paper. In this blog, we’ll focus on the first step to overcome the

hurdles i.e. understanding structure of the exam.

Let

us break down and analyse the exam paper pattern and try to understand what

ACCA on a broad level expects from the students of Diploma IFRS

examination.

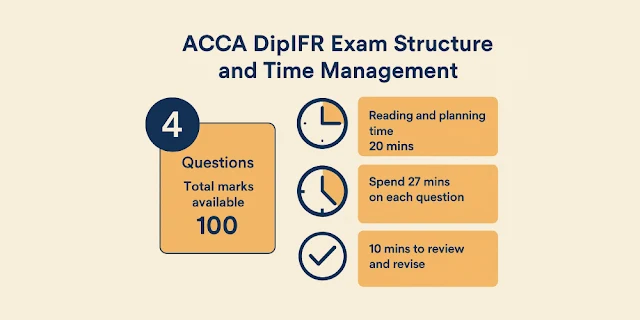

This will help students to plan their revision based on the expectations of

examiner and more importantly to plan 3 hours of examination. Student has 3

hours and 15 minutes at his disposal. Student can use it as per his own

convenience for reading questions and writing answers. However, our suggestion

is to keep total 15 minutes for reading and planning the question paper and

another 10 minutes as a buffer. Thus, out of 195 minutes, remaining 170 minutes

can be utilised to solve the question paper. Thus, 1.7 minutes per mark can be

used as a very broad level guideline for the time management. However,

considering the level of difficulty of a particular question, this time may be revised.

Exam

consists of 100 marks with 4 questions, each attracting 25 marks. All questions

are compulsory and no alternative is available for any question.

Question one:

This

question will involve the preparation of a consolidated financial statement, as examinable within the

syllabus. This question will often include issues that will need to be

addressed prior to performing the consolidation procedures for e.g. procedures

mentioned in IFRS 3 – Business Combinations viz. calculation of purchase

consideration, NCI, goodwill etc. Generally, these issues will relate to the

financial statements of the parent entities prior to their consolidation. A key purpose of this question is to assess

technical consolidation skills. However, the question may also require

candidates to adjust for transactions that have been incorrectly or incompletely

accounted for in the financial statements of group entities (usually the parent

entity). In order to make these adjustments candidates will need to apply the

provisions of relevant IFRS Standards. In Question one, the focus will

primarily on application rather than explanation. No explanations are expected in the question number 1.

Question two:

This

question will often be related to a scenario in which questions arise regarding

the appropriate accounting treatment and/or disclosure of a range of issues. In

this question candidates may be asked to

comment on management’s chosen accounting treatment and determine a more

appropriate one, based on circumstances described in the question. This

question will also contain an ethical

and professional component related to the accounting treatment that is

being examined.

Question three:

This

question will usually deal with one or

two IFRS Standards in some detail. Such a question would require

candidates to describe key features of the IFRS Standard and apply it to two or

more situations that the question describes. In contrast with Question 1, there

will be a limited number of marks available for technical preparation of

financial statements extracts and the majority of marks are available for

identifying and quantifying the appropriate adjustments. However, it is

expected that students can explain how these adjustments will affect line items

in the financial statements.

Question four:

This

question will often present candidates with a scenario or a range of scenarios

for which the correct financial reporting treatment is complex or uncertain.

Often the question will place the candidate in a ‘real-life’ role, for example

chief accountant reporting to the chief executive officer or senior accountant

supervising an assistant. The question frequently requires candidates to

address a series of questions that have been posed by the other party in the

scenario. The question will often ask candidates to present a reply or report

that deals with the appropriate financial reporting of the issues raised in the

scenario. The primary skill in this question is identifying and describing the

issues, rather than the detailed computation of numbers.

Questions

2, 3 and 4 will

be more about identification and explanation of financial reporting issues

rather than of financial statements preparation. Practicing these questions

from the past exam questions is very good exam preparation as generally

candidates find the narrative style questions more challenging than the

numerical style of question one. These past papers continue to be relevant, but

students should bear in mind that sometimes additional query or explanation of

an additional IFRS Standard can be demanded.

We

hope knowing the ACCA Dip-IFRS exam structure will help you approach the exam

with a clear plan. Understanding the types of questions, marks distribution,

and how the paper is set

will make it easier for you to focus on your study and manage your time during

the exam.

Best wishes from Team FinPro!

Thank you for reading our blog, stay tuned for such

insightful tips.

Thank you for reading our blog. Stay tuned for more such insightful tips.

If you have any questions or need assistance, feel free to contact us.

Comments

Post a Comment